How Will CECL Affect Your Not‑for-Profit?

How Will CECL Affect Your Not‑for-Profit?

In 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. Subsequently, FASB has issued ASUs 2018-19, 2019-04, 2019-05, 2019-10, 2019-11, 2020-03, and 2022-02 to clarify ASU 2016-13. All components are codified in the Accounting Standards Codification (ASC) Topic 326.

It is important to note that not-for-profits (NFPs) are within the scope of the ASU. Some of the more common nonprofit financial assets that will be impacted by the adoption of the ASU are trade receivables and contract assets that result from revenue transactions or other income, loan/notes receivable, and loans to officers and employees, and financing receivables, including program-related investments. This list is not all-inclusive and entities are encouraged to read the ASU and look at their financial assets measured at amortized cost to assess the impact the adoption of the ASU will have on their entity.

Assets that are not covered under the ASU include financial assets measured at fair value through net income; and promises to give (pledges receivable) of nonprofit entities. Loans and receivables between entities under common control are also scoped out of the ASU.

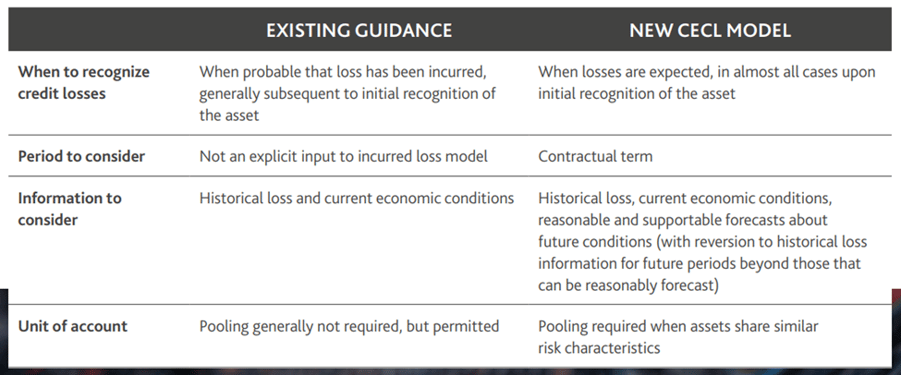

This ASU significantly changes the impairment model for most financial assets carried at amortized cost from an incurred loss model to an expected credit loss model that will be based on an estimate of current expected credit losses (CECL).

The incurred loss method is largely based on historical losses whereby a loss is recognized only after a loss event has occurred or is probable. In other words, we record an allowance for doubtful accounts in anticipation of future losses, based on past experience.

Under the expected credit loss model or CECL model, entities will estimate credit losses over the entire “contractual term” of the instrument from the date of initial recognition of that instrument. The initial measurement of expected credit losses, as well as any subsequent change in the estimate of expected credit losses, is recorded as a credit loss expense (or reversal) in the current period statement of activities. The objective of CECL is to provide financial statement users with an estimate of the new amount the entity expects to collect on these assets. The CECL model removes the threshold of “probable” and requires recognition of credit losses when such losses are “expected.” That is, even though a credit loss event may not have occurred yet, lifetime losses would still be recorded on Day One (i.e., origination or purchase of the asset) under CECL based on the expected future losses.

The chart below outlines the CECL model and its major premises.

The ASU does not prescribe a specific methodology for measuring the allowance for expected credit losses. For example, an entity may use discounted cash flow methods, loss-rate methods, roll-rate methods, probability-of-default methods or methods that utilize an aging schedule.

COMPONENTS OF THE CECL MODEL

Historical Loss Information

Segments or pools are created based on common loan characteristics. A combination of both internal and external information, including macroeconomic variables, are used to establish a relationship between historical losses and other variables.

Current Conditions

To reflect current asset-specific risk characteristics, adjustments to the historical data will need to be considered. These adjustments are usually done through a combination of both qualitative and quantitative factors.

Reasonable & Supportable Forecasts

The forecast period to project expected credit losses should be reasonable and supportable. Document the rationale and provide evidence supporting the reliability and accuracy of economic scenarios and forecasts.

Revision to History

Entities are to revert to historical loss information when unable to make reasonable and supportable forecasts. The reversion method applied must be well documented and is not a policy election.

Expected Credit Loss

The results should represent the current expected credit loss over the remaining contractual term of the financial asset or group of financial assets.

When measuring credit losses under CECL, financial assets that share similar risk characteristics, (e.g., type, size, term, geographical location, etc.) should be evaluated on a collective (pool) basis. Financial assets that do not have similar risk characteristics must be evaluated individually. The ASU provides an indicative list of risk characteristics that includes both credit and non-credit-related characteristics. In practice, it is expected that some credit-related characteristics would be considered.

However, the ASU does require that an entity base its estimate on:

- Available and relevant internal and/or external information about past events, e.g., historical loss experience with similar assets

- Current Conditions

- Reasonable and supportable forecasts that affect the expected collectability of the reported amount of financial assets

For periods beyond which the entity is able to make or obtain reasonable and supportable forecasts of expected credit losses, an entity should revert to historical loss information that is reflective of the contractual term of the financial asset. An entity may revert to historical loss information immediately on a straight-line basis or using another rational and systematic basis, depending on its facts and circumstances. It is important to recognize that the reversion method is not a policy election the entity may make; rather, an entity should support the reversion methodology and period it uses to develop its estimates of expected credit losses.

Management’s estimate of excepted credit loss is recorded as an allowance for credit losses, adjusted for management’s current estimate as updated at each reporting date.

The key changes from the current incurred loss method to the new CECL model are outlined in the chart below.

TRADE RECEIVABLE EXAMPLE:

An example in the ASU regarding estimating the CECL reserve for trade receivables indicates that the application of CECL to short-term receivables is not expected to differ significantly from current practice. However, it is key that entities consider forward-looking information and expectation of losses in developing and documenting the allowance at inception and each reporting period instead of basing the allowance only on incurred losses. Further, entities need to determine if an allowance should be recognized even for current receivables that are not yet past due.

In general, the process for estimating life-of-trade receivables credit losses using an aging schedule can be summarized as follows:

- Pool receivables with similar risk characteristics

- Consider whether historical loss rates need to be adjusted for asset-specific characteristics (e.g., differences in the portfolio mix)

- Adjust historical loss rates for current conditions and reasonable and supportable forecasts. If required (e.g., for longer duration receivables), revert to historical loss rates for future periods beyond those that can be reasonably forecast

- Apply revised loss rates to the amortized cost (i.e., trade receivable balance) to determine the CECL allowance

There is more to this ASU than it seems. Entities should take steps now to familiarize themselves with the provisions of this standard and make assessments as to whether their financial assets fall within the scope of CECL. The required assessments that need to be completed will require time and potentially the assistance of an outside party to ensure all aspects of CECL have been considered and full documentation of the expected losses for each type of financial asset is completed. In addition, the implementation of CECL will require entities to implement the proper internal controls over this process

The ASU is effective for nonprofit entities for fiscal years beginning after Dec. 15, 2022. CECL is generally effective on a modified retrospective basis. An entity must apply the amendments through a cumulative-effect adjustment to net assets as of the beginning of the first reporting period in which the guidance is effective. Of note, CECL requires judgments that are point-in-time specific (e.g., economic conditions). So an assessment of the CECL reserve should be performed as of Jan. 1 and Dec. 31, 2023, for a calendar 2023 year-end entity. There are also numerous required disclosures to enable a user of the financial statements to understand management’s expected credit losses and changes in the estimate of expected credit losses that occurred during a fiscal year.

This article was excerpted from the BDO practice aid titled, “CECL for NonFinancial Institutions.” The full practice aid can be accessed on www.bdo.com at this link.

Written by Brad Bird and Lee Klumpp. Copyright © 2022 BDO USA, LLP. All rights reserved. www.bdo.com