New aid provided by federal agencies in response to the COVID-19 pandemic can impact the presentation of your organization’s Schedule of Expenditures of Federal Awards (SEFA), Notes to the SEFA, and Federal Audit Clearinghouse Data Collection Form (DCF). As you prepare for your audit, it is important to understand the funding you received and identify the COVID-19 related funds separately on the SEFA provided to the auditors to support an effective audit.

Various federal programs provided new aid in response to the COVID-19 pandemic. Certain funds are subject to single audit, which requires recipients to prepare an SEFA. Federal agencies may have incorporated COVID-19 funding into an existing program and CFDA number or established a new COVID-19 program with a unique CFDA number. Federal agencies are required to specifically identify COVID-19 awards, regardless of whether the funding was incorporated into an existing program or a new program.

If an entity receives COVID-19 funds and makes subawards, the information furnished to the subrecipients should distinguish the subawards of incremental COVID-19 funds from non-COVID-19 subawards existing under the program.

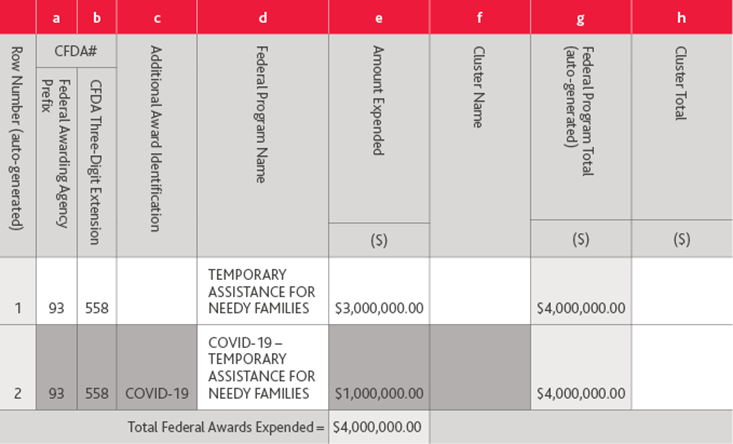

All COVID-19 funding is required to be identified as such per Appendix VII of the OMB 2020 Compliance Supplement (Supplement). To maximize the transparency and accountability of COVID-19 related award expenditures, non-federal entities should separately identify COVID-19 expenditures on the SEFA by presenting this funding on a separate line by CFDA number with “COVID-19” as a prefix to the program name. The following is an example of such presentation based on the OMB 2020 Compliance Supplement Appendix VII.

| COVID-19 Temporary Assistance for Needy Families | 93.558 | $1,000.00 |

| Temporary Assistance for Needy Families | 93.558 | $3,000.00 |

| Total - Temporary Assistance for Needy Families | $4,000.00 |

In addition to separately identifying COVID-19 expenditures on the SEFA, there are new disclosures related to COVID-19 assistance that needs to be incorporated in the notes to the SEFA. Federal sources may have donated personal protective equipment (PPE) to an organization for the COVID-19 response. Nonfederal entities that received this donated PPE should provide the fair market value at the time of receipt as a stand-alone footnote accompanying their SEFA. As the donated PPE does not impact the single audit, the stand-alone footnote may be marked as “unaudited.” PPE that is purchased using federal funds provided to the entity should be reported as federal expenditures.

The amount of donated PPE should not be counted for purposes of assessing whether your organization is over the $750,000 threshold of federal expenditures used to determine if a single audit is required. Donated PPE would also not count toward the Type A and Type B threshold for major program determination.

If a nonprofit organization is subject to single audit, it also requires a DCF submission to the Federal Audit Clearinghouse. At this time the instructions to the DCF have not been amended but entities should follow the OMB Compliance Supplement guidance to show the COVID-19 programs separately. The OMB Compliance Supplement recommends that the COVID funds should be entered on a separate row by CFDA number with “COVID-19” in the “Additional Award Identification” column. See example below:

As you prepare your internal SEFA be sure to follow this guidance.